Saudi Arabian Monetary Authority (SAMA) Cyber security framework establishes the policies and guidelines to implement, control, monitor, and improve cybersecurity.

The framework of Saudi Arabian Monetary Authority (SAMA) Cyber security framework will take into consideration the:

- Electrical information

- Paper-based information

- Databases and web applications

- Information technology hardware

- Information technologies infrastructure

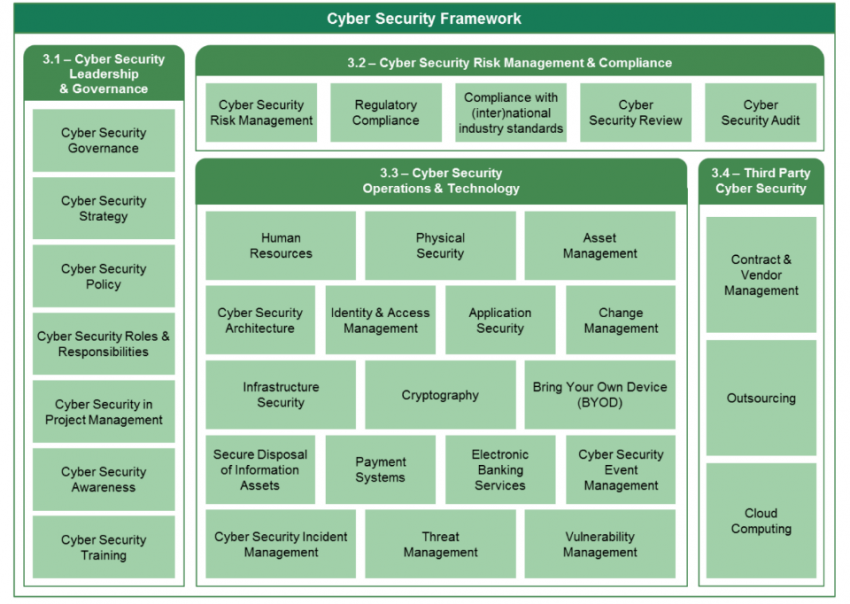

There are 4 main domains in Saudi Arabian Monetary Authority (SAMA) Cyber security framework:

- Cyber security Leadership & Governance

- Cyber security Risk Management & Compliance

- Cyber security Operation & Technology

- Third-Party Cyber Security